Interest deductions on residential property income & Bright-line test 2021: What the proposed changes mean to you

There have been proposed changes for residential properties acquired on or after 27 March. The current law states that residential property owners can deduct the interest on loans when calculating their taxable incomes and claim them as an expense. This reduces the tax amount they need to pay.

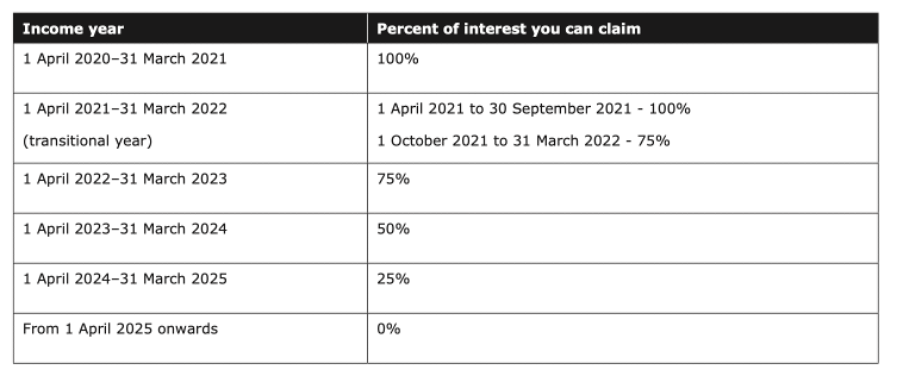

From 1 October 2021, there will be no interest deductions allowed on residential properties acquired on or after 27 March 2021. Interest on loans can still be claimed as an expense; however, the amount you can claim will be reduced over the next four years until it is completely eliminated. The table below shows that the interest amount claimed as an expense will be reduced by 25% each income year and eliminated by 2025-26 income year.

You can request further information or give us a call, and we will guide you through the latest changes and what they mean to you and your income tax.

What happens if you got a loan to improve or maintain your property on or after 27 March 2021? You will not be able to claim interest on this loan as an expense starting from 1 October 2021. This means that you will pay more tax on any property income you receive.

Say you made an offer before 27 March 2021 but acquired property on 27 March. Then your property will be treated as it was acquired before 27 March. This means that you will be able to claim interest as an expense based on the table provided above.

Obtaining any additional debt from drawing on the loan or taking a new loan related to the investment property on or after 27 March 20201 means interest on that portion of the loan will not be claimed as an expense after 1 October 2021.

When obtaining a loan for business use but secured against residential property, no changes are applied. Builders and property developers will be able to claim interest on a loan as an expense.

Bright-line test proposed changes

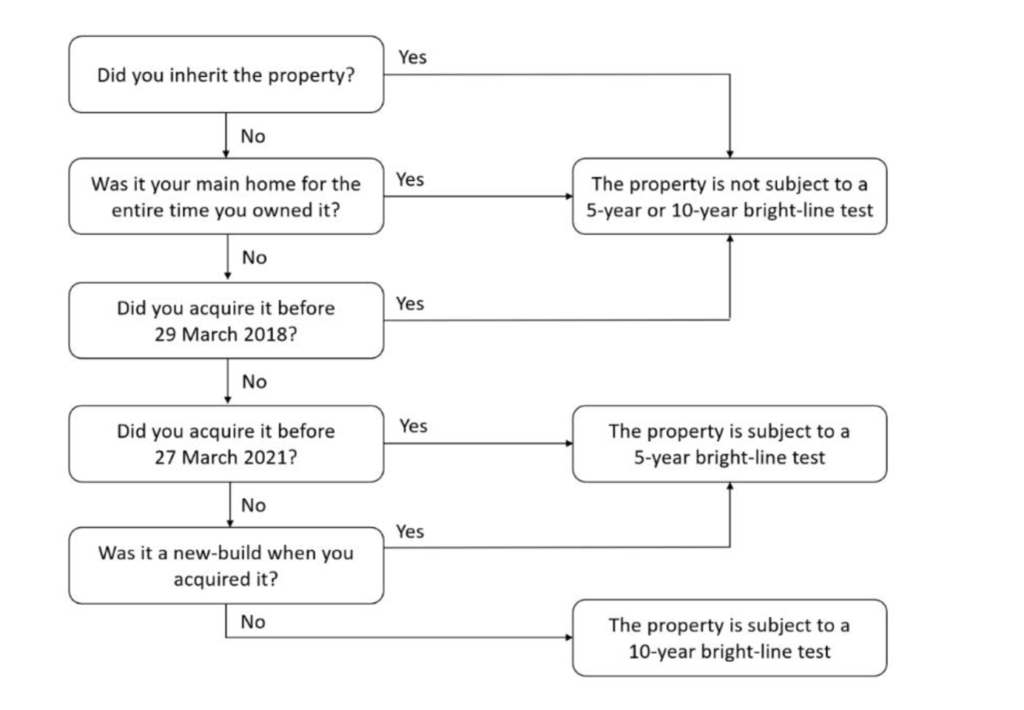

The government proposed the bright-line test to be extended from 5 to 10 years, which means that you will have to pay tax on any profit made through property increasing value over time for a set period after acquiring a residential property. Newly built houses are an exception and inherited properties and those considered as owner’s primary home for the entire time they owned it.

The chart below provided by IRD explain the proposed changes to the bright-line test.

The date you acquired a property determines whether the bright-line is 5 or 10 years. This will also determine which set of rules relating to the main home exclusion and change of use will apply to your property.

There is no clear definition of a new build as yet, and it will be defined and clarified in consultation with the tax and property communities. The intention is to define a new build as property acquired within a year of receiving a code of compliance certificate under Building Act 2004.

If a residential property, including new builds, is acquired on or after 27 March 2021, there may be a “change-of-use” rule applied by the government. This basically means that tax will be calculated differently if the property was not used as the owner’s main home for over 12 months at a time during the applicable bright-line period.

If the owner does not use the property as the main home for 12 months or less there is no change of use (for example) if the owner takes a few months to move into our out of a property this till means that the days are counted as main home use and the bright-line test is not applied.

The owner of a property subject to the change-of-use rule will be required to pay income tax on a proportion of the profit made through the property increasing in value, calculated as follows:

• subtract the purchase price from the sale price

• subtract the cost of capital improvements the owner has made

• subtract the costs to buy and sell the property, and

• multiply the result by the proportion of time the property was not being used as the owner’s main home.

What the proposed changes mean for you

If you own property for more than ten years (or over five years for new builds), you won’t have to pay tax under the bright-line test.

If a property is sold within ten years of acquiring it (or five years for a new build) and it was the owner’s main home for the entire time, there is no obligation to pay tax under the bright-line test on any value gain of the whole period. In case of the property being used for other purposes for over 12 months during the time owned, there is an obligation to pay income tax on the value gained over time, and it is considered as profit.

If the owner decided to sell the property within ten years of acquiring it (or five years for a new build) and it was never owner’s main home for the entire time of ownership, there will be income tax to pay on any value gained under the bright-line test.

Contact Spectrum Accounting for an initial consultation, and as tax consultants, we will help you have all your taxes under control.